Trade Commodities with InvestorHubFx

What Are Commodities?

Commodities

Commodities are the only physical items to be purchased and sold on trading exchanges in capital markets. They usually consist of raw materials that are mined from the ground or extracted from the sea, and sit at the beginning of the supply chain before being sold at greater prices to processors and manufacturers for conversion into products.

Trade long and short

Diversify your portfolio

Gain exposure to major commodity groups (metals, energy and agriculture)

Hedge open positions or a portfolio of commodity stocks/ ETFs

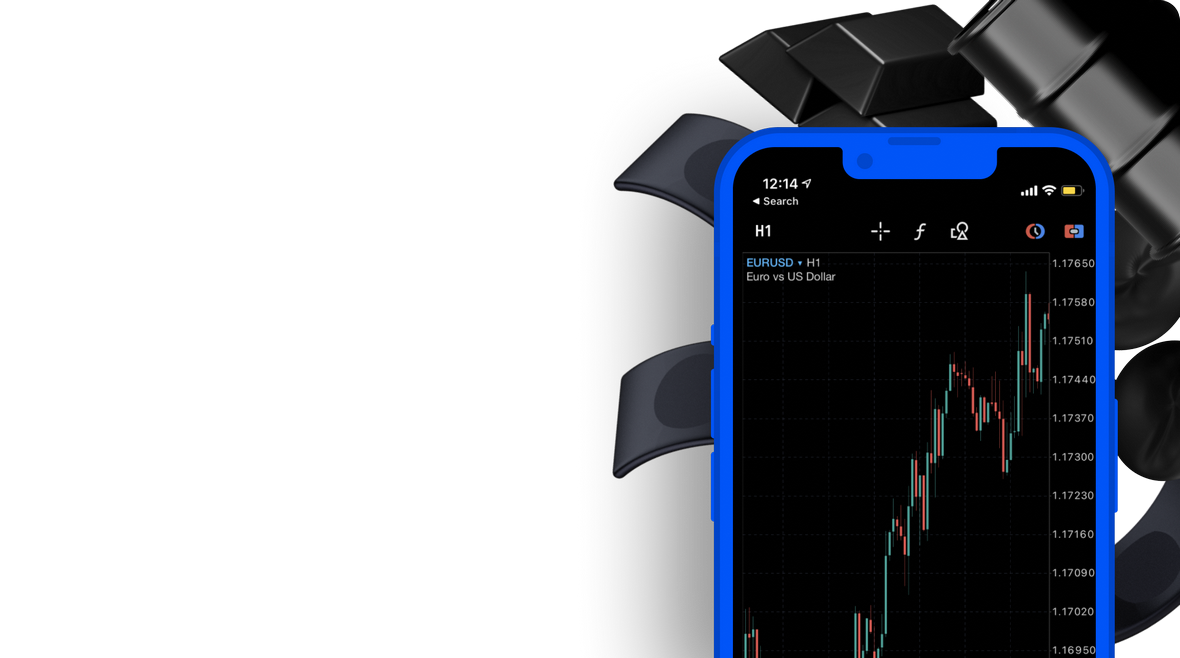

Everything a Trader Needs

- Over 10,000 Trading Instruments

- Cutting-edge Trading Analytics

- Top Shelf Trading Environment

- Multiple Funding Methods

- Fully Regulated and Licensed

Why Trade with InvestorHubFx?

Multi-Asset Platform

Trade over 10,000 instruments covering stocks, crypto, forex, commodities and more

Top Shelf Trading Environment

Enjoy top-shelf trading conditions, with costs that beat 80% of our peers

Veteran Expertise

InvestorHubFx’s team consists of trading veterans with a deep, first-hand understanding of markets

Experience-Driven Innovation

InvestorHubFx’s product developers aren’t just technical experts – they're traders who’ve been in the trenches themselves

Advanced Trading Tools

Cutting-edge trading tools developed by an in-house team to drive the success of traders at all levels

Fully Regulated Brokerage

We’re licensed and fully compliant across multiple jurisdictions to ensure the highest levels of integrity

How to Get Started

Register

Verify

Fund

Trade

FAQ

What are commodities?

Commodities are physical assets, usually produced in high volumes that are then traded on a commodity exchange (oil, corn, copper etc.). Their prices fluctuate daily and can provide high levels of volatility.

How are commodity CFD prices calculated?

Our commodity CFD prices are based on the underlying spot markets (also called cash markets).

What is contango and backwardation?

Contango is when future commodity prices are lower than spot commodity prices, as traders expect the commodity to fall in value in the future. Backwardation, which more commonly occurs, is when futures prices are higher than current commodity spot prices.

What are the main market drivers for commodity prices?

A broad range of fundamental drivers for commodities include inflation, growth, geopolitical tensions, weather, US dollar strength/weakness, supply and demand.

Where can I find contract specifications for commodity CFDs within MT4?

MT4 Market Watch > Right mouse click over market > Choose “Specification” from the dropdown menu