Why Trade with InvestorHubFx?

Multi-Asset Platform

Trade over 10,000 instruments covering stocks, crypto, forex, commodities and more

Top Shelf Trading Environment

Enjoy top-shelf trading conditions, with costs that beat 80% of our peers

Veteran Expertise

InvestorHubFx’s team consists of trading veterans with a deep, first-hand understanding of markets

Experience-Driven Innovation

InvestorHubFx’s product developers aren’t just technical experts – they're traders who’ve been in the trenches themselves

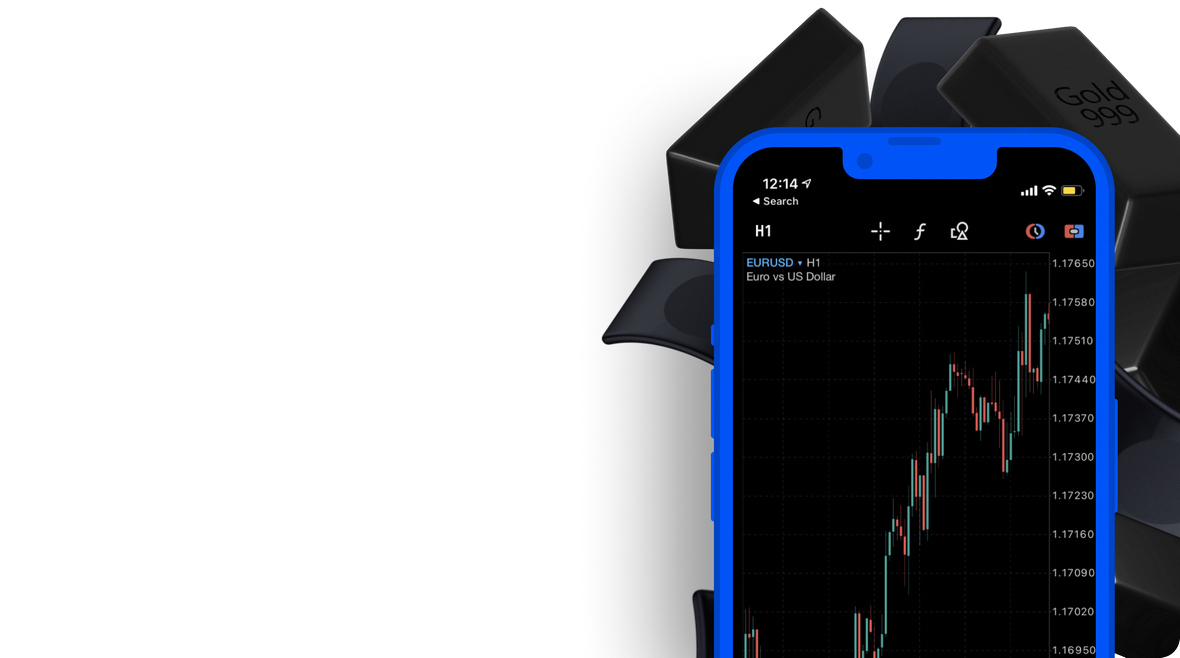

Advanced Trading Tools

Cutting-edge trading tools developed by an in-house team to drive the success of traders at all levels

Fully Regulated Brokerage

We’re licensed and fully compliant across multiple jurisdictions to ensure the highest levels of integrity

How to Get Started

1

Register

2

Verify

3

Fund

4