Arbidyne January Fund Newsletter

-

By InvestorHubFx

By InvestorHubFx - January 20, 2022

- InvestorHubFx Analysis

Jan 20th, 2022

The Arbidyne Absolute Return Fund implements a long/short investment process which aims to produce consistently positive returns in multiple market cycles. Our primary focus is USAn and US equities; and complement this strategy with global index futures, currencies and government bonds when opportunities present.

Net performance in December was 2.89%

Net performance since fund inception is -4.47%

Commentary

December was a tough month for our portfolio.

Frustratingly, our recent call of rising rates played out as we expected, but we failed to take full advantage of it. We also took hits in multiple stock positions.

When trying to make 30-50% a year, we are taking many calculated risks, and sometimes they go against us. Based on our trading history and performance metrics, we actually expect a 10% drawdown each year and every 4-5 years we know that a 20% drawdown is possible. The unfortunate part is we have way of knowing when these drawdowns will happen. Most people don’t mind a drawdown when their account is up 30%, but when starting out, these drawdowns are painful.

2022 is a new year and it’s important we don’t let a bad month cloud our trading. We have developed a process for trade selection and portfolio construction that has provided solid returns over the long term. We know that if we follow our process, profits are the by-product. We continue to follow this process and as such, I can report at the time of writing, the portfolio has already had a meaningful rebound in January.

Let’s get on to markets by starting with Valuations

Lower rates and money printing has been driving asset prices higher since the GFC low in 2009. Equities, real estate, commodities, bonds have all been going up. And the new kid on the block, cryptocurrencies and digital tokens (NFT’s) have been nothing short of a mania.

Charles Mackay’s book ‘Extraordinary Popular Delusions and the Madness of Crowds’ was published in 1841 is an early study on crowd psychology and describes several famous bubbles, the Mississippi Scheme, the South Sea Bubble and perhaps the most famous of all, the Dutch Tulip bubble. I believe what is happening in crypto and especially the NFT’s would overshadow all others.

|

CryptoPunk #7523. Image: Larva Labs Sold for US$11.7 Million One of 10,000 randomly generated unique digital characters, and are some of the first examples of non-fungible tokens released on the Ethereum blockchain. |

“Men, it has been well said, think in herds; it will be seen that they go mad in herds, while they only recover their senses slowly, and one by one.”

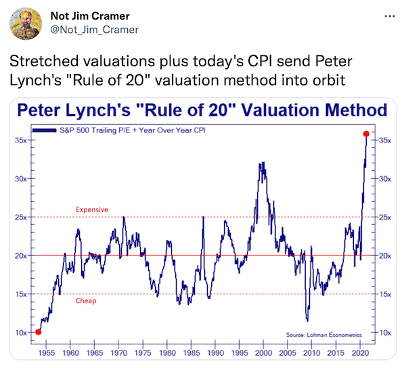

It is not just NFT’s though. Everything is overvalued.

“Today the P/E ratio of the market is in the top few percent of the historical range and the economy is in the worst few percent. This is completely without precedent. It is a privilege as a market historian to experience a major stock bubble once again.” ~ Jeremy Grantham

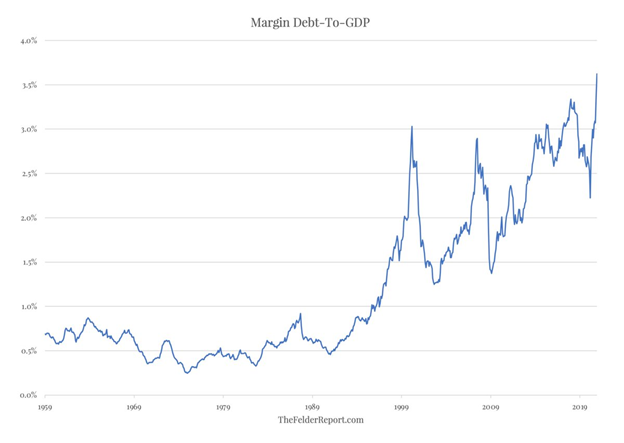

“Equity valuations have soared far above anything we have ever seen before. Euphoric, even manic, sentiment towards risk assets and the riskiest vehicles for playing them is on display everywhere you look.” ~ Jesse Felder via TheFelderReport.com

“People always ask me what is going on in the markets. It is simple. Greatest Speculative Bubble of All Time in All Things. By two orders of magnitude. #FlyingPigs360” ~ tweet from Michael Burry “The Big Short”

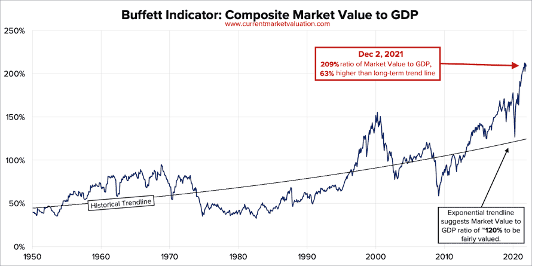

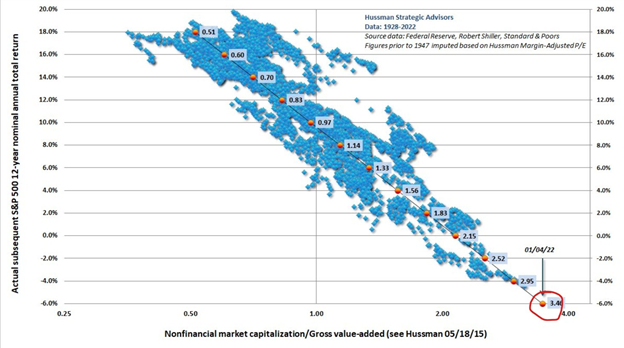

Warren Buffett indicator showing we are well above trend

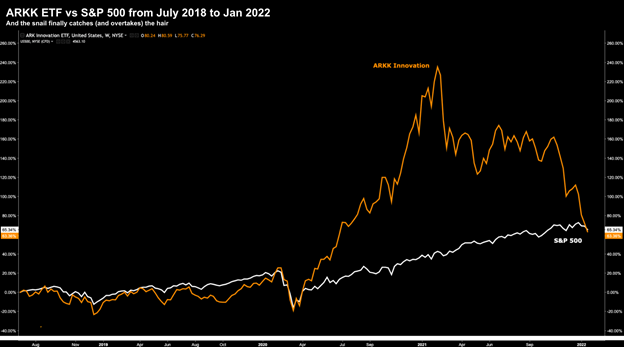

Cathie Wood’s ARKK Innovation ETF, the poster child of hyper-growth high-priced names shows what can happen when fundamentals start to matter again.

William Martin famously said “The job of the Federal Reserve, is “to take away the punch bowl just as the party gets going”

Two key drivers that pushed these valuations to extremes are now being removed: Money printing and lowing rates.

2022 is the year the Fed plans to reduce its balance sheet.

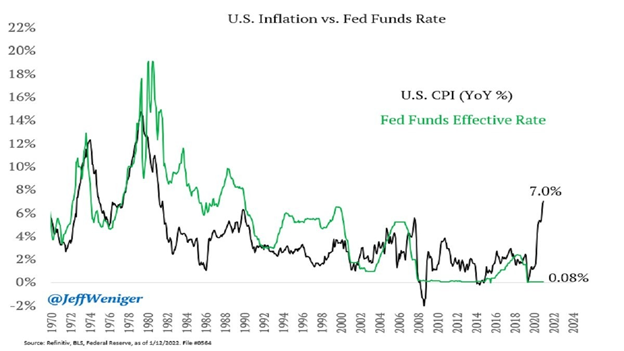

Rising inflation and a strengthening economy is going to see interest rates higher this year. The important takeaway for rates: it is not low rates that drive asset prices higher. It is falling rates. And rates are now rising.

We have already discussed the reasons for why rates will rise in previous letters, so I won’t go over them again. However, as a recap sometimes a picture is worth a thousand words.

What does this mean for the markets this year? Fasten your seat-belts as the market could be in for a wild ride in the coming months. At best we might see sideways chop, at worst a decent correction. Volatility is likely to keep on increasing. Money will likely continue to flow out of high price growth names into underloved and underowned value names.

The Fed needs to restore credibility. And in order to do this they might need to stop pandering to the market and start tackling this inflation genie which is now out of the bottle.

Tough times for markets going forward – via Hussman Strategic Advisors

So what’s the good news?

Over the past decade, Active Management has been underperforming Passive Management. All you had to do was buy the index and watch it go up. Anytime the market experienced some pain, the Fed and other central banks would step in and ease conditions, and markets would rebound to new highs. The market has been conditioned to just ‘buy the f**king dip’. It was easy for the Fed to reduce rates or increase the money supply, as there was no inflation to be seen. Those days are gone. The Fed now has to deal with sustained unwanted inflation, and the market has not fully come to terms with what this means to valuations.

Active management should outperform. Even in severe bear markets there are asset classes that go up. Money flows out of one and into another, and it’s our job to ride these flows.

Our aim is to grow your wealth whilst managing risk. Investing is a marathon, not a sprint and new opportunities in the market are always going to present themselves. Our aim is to find trades where the upside outweighs the downside, and then diligently execute our trade plans; profitable trades then tend to be a byproduct of this process.

If you have any questions or comments, please drop us a line at [email protected]

For new clients:

Since we are running individually managed accounts, new clients will not always have the same positions as our master tracking account when they first join, and as a result may not see the same monthly performance. This is because we cannot always buy new accounts into the same positions that were entered into before they joined the fund. We consider this on a case-by-case basis and evaluate whether it is in the individual client’s best interests to enter into existing positions. New accounts should see their accounts begin to track our performance benchmark approximately 3 months after joining.

DISCLAIMER: This information has been prepared by Arbidyne Pty Ltd.. This information is general in nature and nothing in this letter should be considered investment advice. The commentary reflects Arbidyne’s views and beliefs at the time of preparation, which are subject to change without notice. No representations or warranties are made by Arbidyne as to their accuracy or reliability. To the extent permitted by law, no liability is accepted by Arbidyne for any loss or damage as a result of any reliance on this information.