Yellen Returns, Ethereum Hits New All-Time High

-

By InvestorHubFx

By InvestorHubFx - January 20, 2021

- InvestorHubFx Analysis

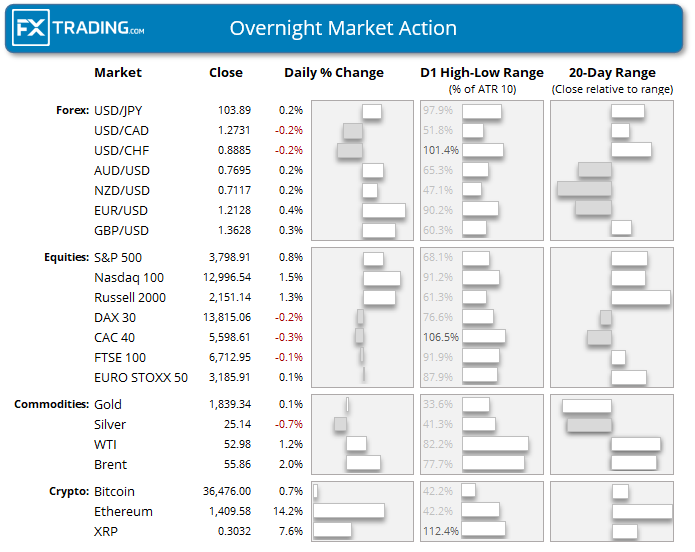

Former Fed Chair Janet Yellen, who is now a nominee to become Treasury Secretary in the Biden Administration spoke overnight and gave her full support for further stimulus. She urged lawmakers to “act big” during her senate hearing last night, which gave equity markets another boost. The Nasdaq-100 (USTEC) was the stronger performer among index majors, gaining 1.5% by the session close. The S&P 500 (US500) was 0.8% higher.

The positive sentiment on Wall Street saw USD weaker again, with the US dollar index falling to a 2-session low after finding resistance at its 50-day eMA with a small bearish hammer.

Ethereum (ETHUSD) smashed its way to a new all-time high overnight, leaving its big brother Bitcoin (BTCUSD) behind for dust. The cryptocurrency has rallied nearly 90% this month alone, in part because it remains a viable and more affordable alternative to Bitcoin which hit $40 earlier this month. We had previously warned that implied volatility for Ethereum was higher than Bitcoin’s, and we are now witnessing historical volatility play out that very scenario.

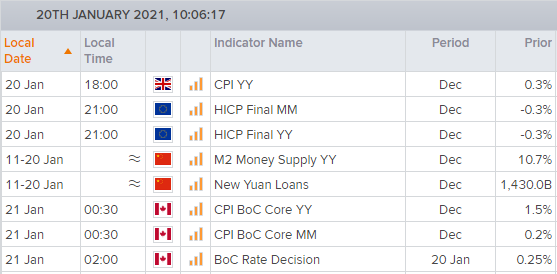

Today’s Calendar Events (Times are GMT+11 Sydney)

No policy change is expected in BOC’s meeting (Bank of Canada), so interest rates are expected to remain at 0.25% and QE at its current rate of at least CA $4 billion per week. They were relatively upbeat at their last meeting, although also warned that rates won’t likely be raised until 2023 when they expect economic slack to be absorbed. Governor Tiff Macklem holds a press conference at 03:00 (Sydney) so any hawkish comments could be bullish for CAD.

Joe Biden will be officially inaugurated overnight. The pre-session begins from 01:30 and the inauguration starts around 03:30. It’s unlikely to be a volatile event, unless of course it turns out into an all-out civil war. But this is highly unlikely given the thousands of military and secret service members surrounding the event, whilst the world watches.

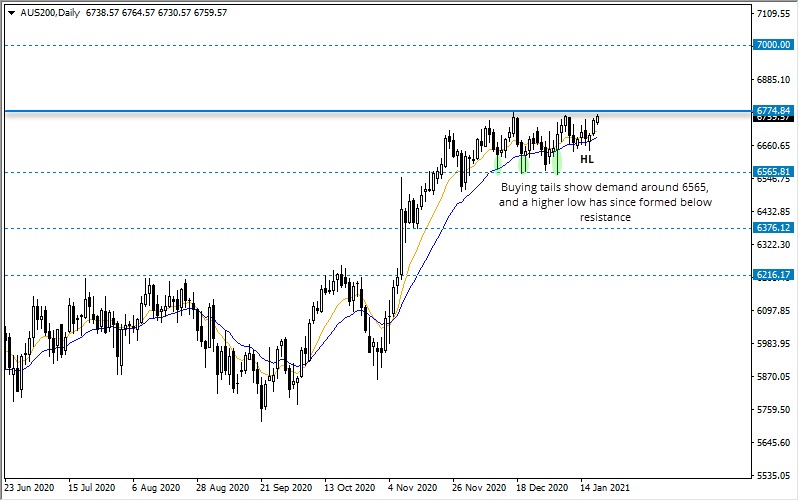

ASX 200 (AUS200): Ready for Lift-Off?

We highlighted the potential for a bullish breakout on the ASX 200 last week. Yet, it is to materialise, yet we continue to monitor the index for an eventual break higher.

A series of buying tails shows demand around 6,565 and higher lows have since formed beneath key resistance (6,774). Yesterday’ bullish candle has taken price action just below the cycle highs and early trade today has also pushed higher.

- Bulls can wait for a break above 6,774 to either trade the breakout long or wait for a retracement towards support.

- If we see a momentum shift beneath 6,774 resistance, counter-trend traders could consider selling into highs to trade the range and initially target the lows around 6,650.

USD/CNH: Correction Complete?

The daily trend on USD/CNH remains in a well-established downtrend. Apart from the spike higher on the 4th of November (which respected the 50-day eMA and closed the day lower anyway), retracements have remained orderly as part of a healthy trend.

Prices have retraced towards 6.4984 resistance in a 3-wave move, and a 2-bar bearish reversal has also formed to suggest the correction may have completed.

- Bears could consider shorting a break of yesterday’s low and target the lows around 6.4120

- A break above Monday’s high suggests a deeper correction, although the daily trend remains bearish below the 6.5524 high.

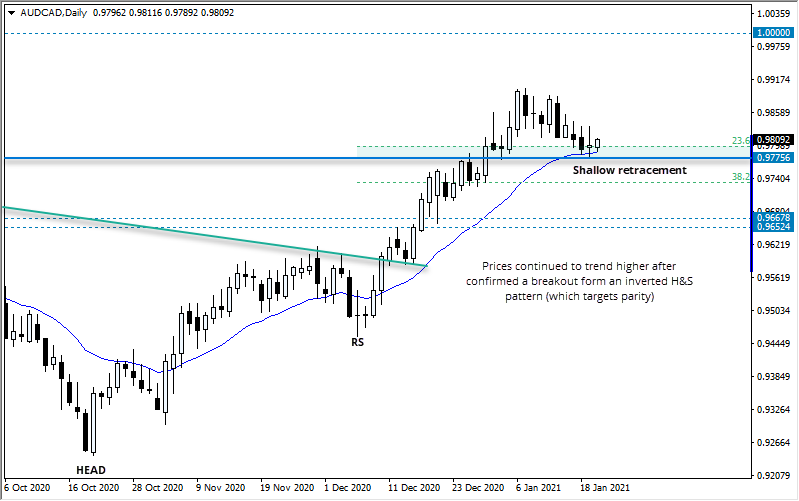

AUD/CAD: Target for Parity Remains in Play

Back in December we highlighted the potential for AUD/CAD to trade towards parity, as part of an inverted head and shoulders (H&S) continuation pattern. Last week the cross hit its highest level since June 2018 and prices are now undergoing a correction.

A spinning top doji has formed at the 23.6% Fibonacci retracement and the 20-day eMA is providing dynamic support. Given the strength of the daily trend and the shallow pullback, we suspect the corrective low may be in place.

- Bulls can enter long with a break above yesterday’s high. Or consider scaling in with a wide stop and adding to the position if it moves higher.

- A break below 0.9775 could see it retrace towards the 38.2% Fibonacci level, and we could then seek bullish setups around there if volatility remains low.