InvestorHubFx Navigator Guide

Please use the search or select category

How to use the InvestorHubFx Navigator

-

By InvestorHubFx

By InvestorHubFx - OCT 19, 2022

The InvestorHubFx Navigator is a tool that traders can use to identify opportunities in the market, by filtering and assessing different criteria.

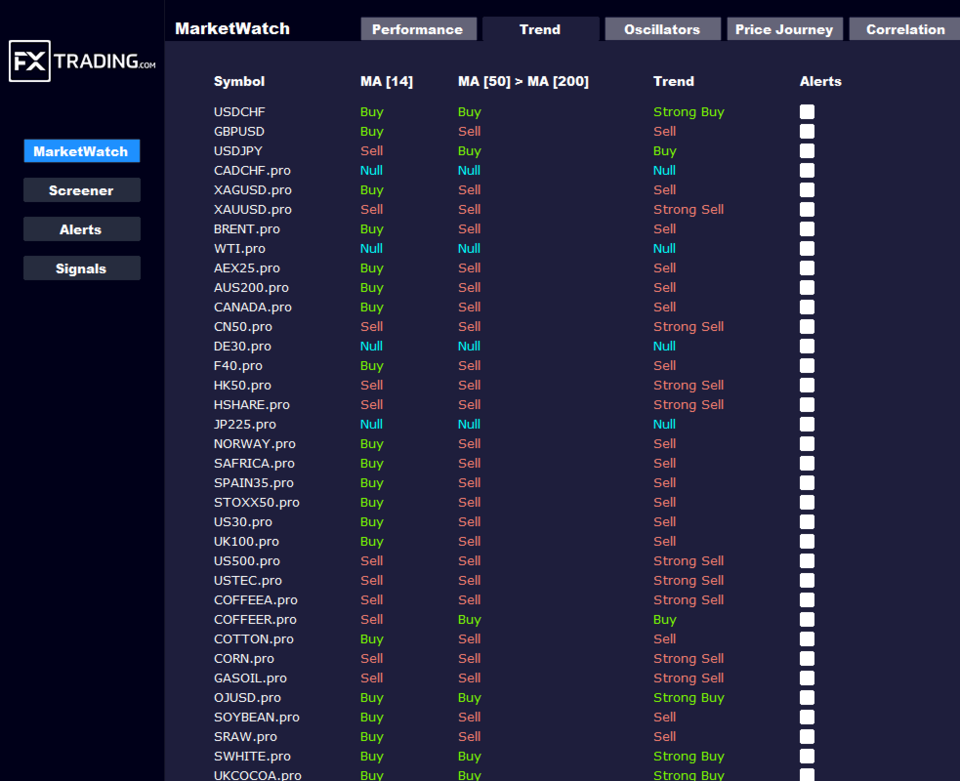

Depending on your trading strategy, you may like to use the navigator to identify markets that are trending, with all three components of trend in line, or you may like to trade markets that are not trending, and looking to trade within balanced market conditions.

The image below shows symbols by highest to lowest movement in 2021. To get the list, you can click on the 2021 header (or any header). This allows you to get real time data on what is moving and what has moved. Being clear on where the market sits and what movements have occurred is very important. The InvestorHubFx Navigator allows you to quickly identify market movers and make better, more informed decisions.

When you find a market that fits your requirements (movement/volatility etc.), you can investigate trends via the trend tab.

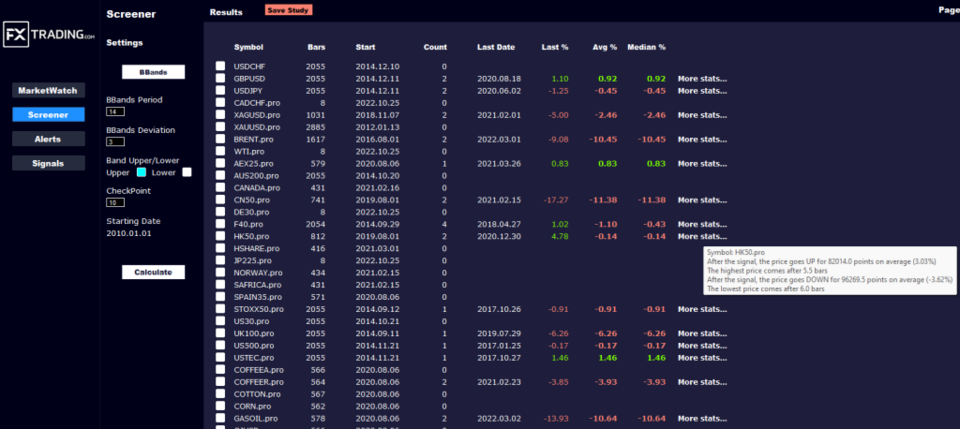

The below screenshot shows the bollinger band studies for a range of symbols. When hovering over "More Stats..." the dialogue box brings up information on average high and average low and the bar these points are reached. It also shows the count (or times this has signal has occurred since the start date). This can help you identify trading opportunities based on the criteria you input.

Seeing how many times this trade setup occurs, the last%, average% and median% of the trades in one simple display is an incredible feature to help you identify trade opportunities that may offer consistency or match your risk criteria and trading style.

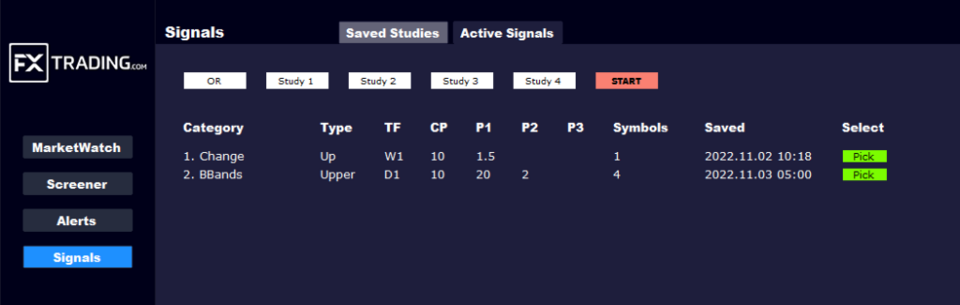

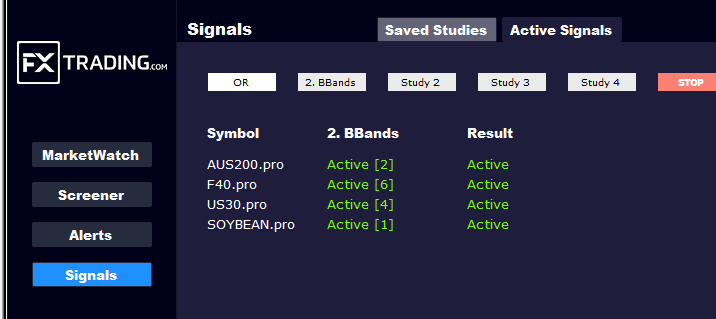

Once you find some setups that fit your plan (after checking out the average movement on each signal) you can save it, by selecting the symbol and saving the study. Later, you can view the active signals for each selection to see what symbols have reached the entry condition. Pick the study (image below) then press start to see what symbols are active. This filtering process helps you keeping track of the best setups available right now, without having to scan each and every chart, assess and filter what might be a good set up or not. Setting up your studies based on the data will be highly valuable long term.

The above image shows that there are 4 active symbols (symbols that reached the conditions of the studies I selected). This means I don't have to spend as much time looking for these setups, my ideal trades have been set up as studies and I can check periodically to see if anything meets the conditions.